Language

FREE LIFE INSURANCE AUDIT

Get a Free Check-Up on Your Life Insurance Policy

Checking your policy can help verify information and possibly save you money or receive additional benefits at no extra cost.

or call (888) 996-8818

COMPLIMENTARY OFFER

NO OBLIGATION

100% CONFIDENTIAL

There Are Many Reasons to Get a Life Insurance

Policy Audit Every 3-5 Years

Or ANYTIME If it is an IUL (Index Universal Life)

Underfunding and underperformance issues

Interest, legislation, and financial market fluctuations

Financial strength of insurance carrier changes

New enhancements in life insurance products

Loans, withdrawals, or other policy changes

Lifestyle changes requiring more coverage

More than 95% of IUL Policies are not Structured Properly or Designed Correctly Causes Excessive Fees and Possible Millions of dollars loss

***

Want to See How much a correct IUL Policy Design can save you?

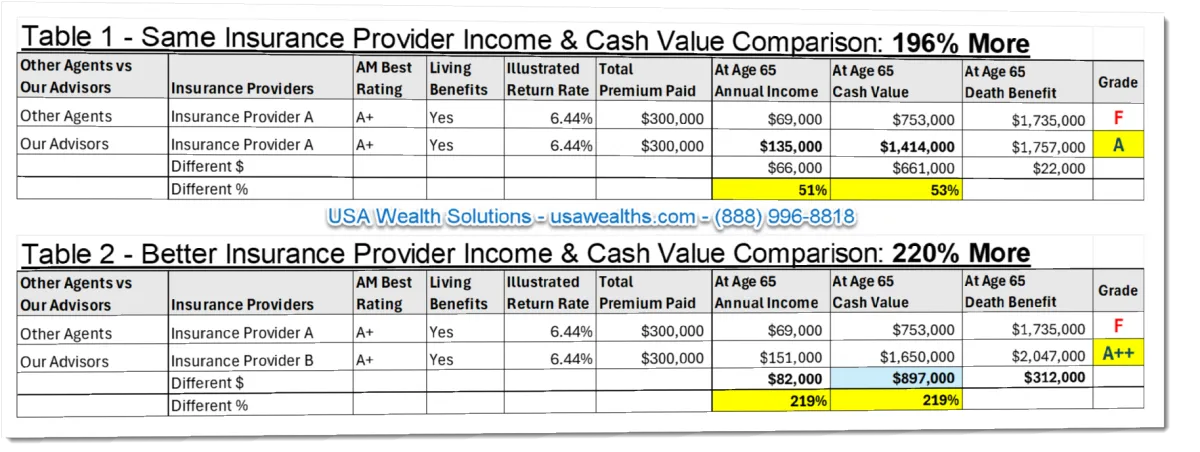

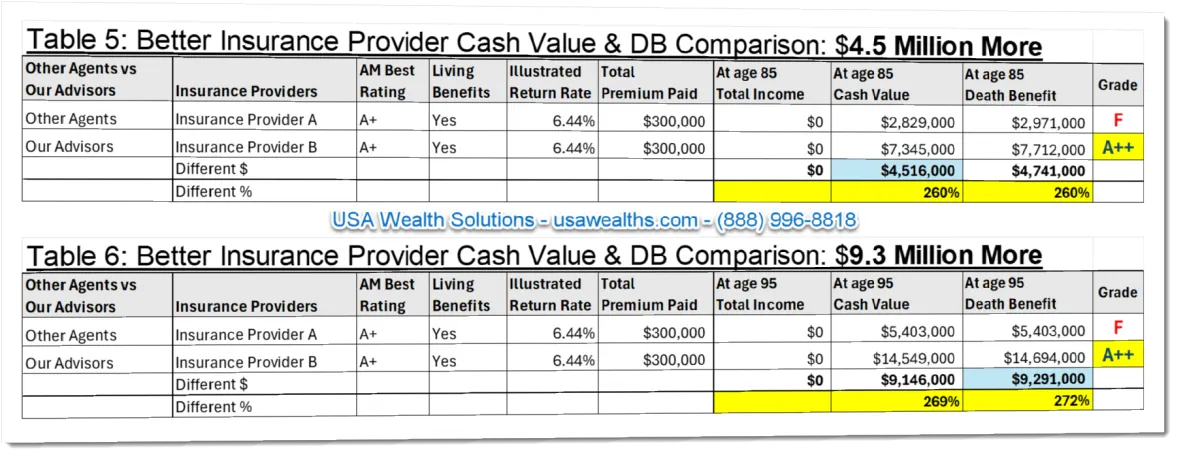

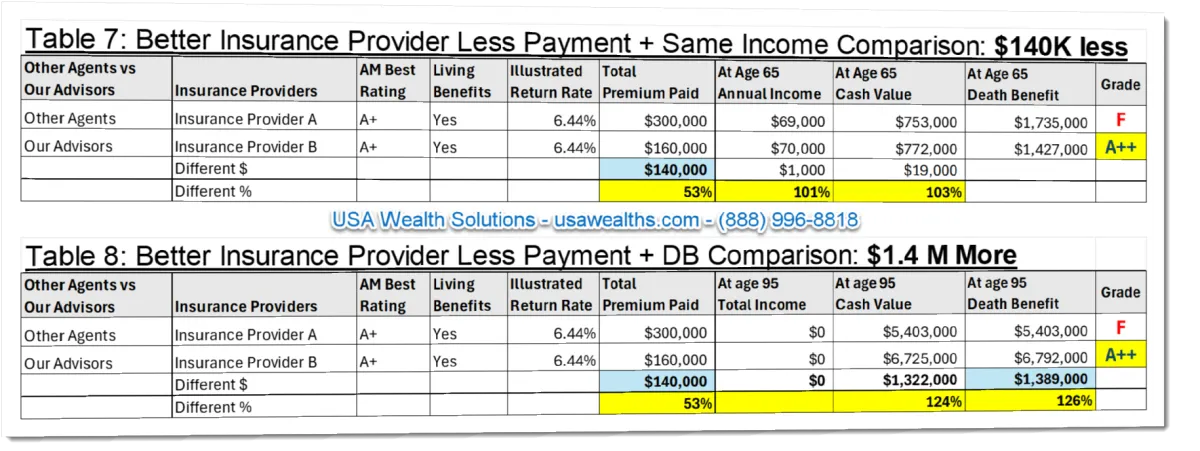

These illustrated case studies use the actual illustrations from insurance carriers with hypothetical interest rate of 6.44%. These are LOSS due to avoidable excessive fees only due to incorrect design. The illustrated original policy is graded F (<60% of the correct design).

1. Case Study #1 (Income distribution at 65): Increases DOUBLE Income & Cash Value at age 65 with the exact same provider => 196% More

2. Case Study #2: Increases DOUBLE + 20% More Income & Cash Value at age 65 with the BETTER A+ provider => 219% More

3. Case Study #3 (Income distribution at 65) Increases about 1.5 Million Dollars More at age 85 with the exact same provider => 175% More

4. Case Study #4 (Income distribution at 65): Increases about 2.5 Million Dollars More at age 85 with the BETTER A+ provider => 237% More

5. Case Study #5 (No Income distribution): Increases about 4.5 Million Dollars More Cash Value at age 85 with the BETTER A+ provider => 160% More

6. Case Study #6 (No Income distribution): Increases about 9.3 Million Dollars More Cash Value at age 95 with the BETTER A+ provider => 269% More

7. Case Study #7 (less Premium Paid with Income): Pay 140 Thousand Dollars Less For the same benefits with the BETTER A+ provider

8. Case Study #8 (less Premium Paid without Income): Pay 140 Thousand Dollars Less and Get 1.4 Million More at age 95 with the BETTER A+ provider

There Are Three Possible Outcomes

Lower Costs

Maintain the same level of benefits or cash value but pay less in premiums

Enhanced Benefits

Receive better coverage or cash value for the same amount you’re currently paying.

Suitability

Keep the same policy and have a peace of mind that no changes are required.

Can a Life Insurance Policy Audit Really Help Save Me Money or Get More Benefits at No Extra Cost?

Let me know if this sounds familiar…

Several years ago, maybe even decades ago, you made the decision to purchase a life insurance policy. You knew it was a smart move and thought to yourself:

“This Will Be There When I Need It Most…”

Does this sound familiar?

Life went on... and you got married, changed jobs, or moved to a new place. Whatever your situation may be, you trusted that your life insurance policy would always be there to provide financial protection for you and your family.

And that was it! You checked that life insurance box off your list, thinking

You were set for life.

However, that’s often not the reality…

Many people believe they have a certain type of life insurance policy, only to later discover it offers fewer benefits than expected. In some cases, a missed premium payment may have caused the policy to underperform significantly compared to its original projections.

Sometimes, this underperformance isn't even the policyholder’s fault.

Global economic events and fluctuations in interest rates can impact life insurance policies and the benefits they provide.

Additionally, medical advancements and increased life expectancy have made today’s life insurance products more efficient, offering advantages that older policies cannot match.

This highlights the importance of reviewing your policy every 3-5 years.

By reassessing your policy, you’ll likely find yourself in one of three scenarios:

You can save money while maintaining the same level of benefits with a new policy.

You can access additional benefits at no extra cost with an updated policy.

Your current policy is performing well, giving you peace of mind.

While we’d like to think most people fall into the third scenario, the reality is that many do not.

In fact…

9 Out of 10 Policies Reviewed

Provide Strong Evidence for

Replacement and Upgrade

I am pleased to offer you a complimentary review of your life insurance policy to ensure it’s performing as expected and that its terms align with your current lifestyle and needs.

This review comes with no obligation or cost to you.

Through this audit, you may find opportunities to save on premiums or receive additional benefits without any added expense.

At the very least, you’ll gain peace of mind knowing that your current life insurance policy is well-suited to your circumstances and requires no further adjustments.

On this page, you’ll find detailed information about what’s included in the audit and the timeline for receiving your customized report.

I encourage you to take advantage of this offer, as I believe it will provide valuable insights.

I look forward to connecting with you soon!

Schedule A Time to Review Your Results!

To take a closer look at your retirement plan and the potential tax

landmines to be aware of, schedule a time to meet with me.

Who Provides the Complimentary Analysis?

Michael Tran

Chief Financial Advisor

Email: [email protected]

“I really believe that my ability will take these wealth building concepts and put them into effective strategies for my clients.”

CEO & Chief Financial Advisor

Leading USA Wealth Solutions Inc. is Michael Tran, the CEO and Chief Financial Advisor, who is dedicated to empowering individuals, families, and businesses to achieve financial stability and peace of mind. His unwavering commitment drives the company's mission to provide exceptional financial guidance and solutions tailored to each client's unique needs.

Michael distinguishes himself as a rare financial advisor holding licenses in Life, Accident & Health, or Sickness insurance, as well as the coveted title of SEC registered Investment Advisor Representative (IAR). His unique qualifications empower him to guide clients toward their financial objectives through a diverse range of life insurance solutions, including Mortgage Protection, Death & Living Benefits, IUL (Indexed Universal Life), Annuities, Long Term Care, and Disability Insurance. Furthermore, Michael offers expertise in investment and portfolio management, encompassing stocks, bonds, mutual funds, ETFs, and more.

His comprehensive approach extends to providing strategic financial planning to both pre-retired and retired individuals, as well as business owners, all with the aim of facilitating total wealth optimization and establishing dependable income sources for retirement. Michael leverages a blend of conventional and alternative asset classes to tailor the most suitable portfolios for his clients.

Schedule A Time to Review Your Results!

A sound financial plan contributes up to 85% to personal financial success. A Incorrectly designed or improperly structured policy could cause unnecessary excessive fees. These hidden losses, if left unnoticed, can cost hundreds of thousands or even millions of dollars over time, severely impacting your financial situation when you retire.

Disclosure

The projections and information provided in this report are hypothetical and do not represent actual outcomes or guarantee future results. Outcomes may vary, potentially being more or less favorable due to factors beyond our control, such as changes in investment returns, inflation rates, tax rates, and product expenses. The content of this report is not intended to serve as legal, tax, or accounting advice. Please consult a tax advisor for personalized tax guidance.

Please note that insurance companies are solely responsible for determining insurability. Certain individuals may be deemed uninsurable based on health conditions, occupation, or lifestyle choices. All guarantees are contingent on the claims-paying ability of the issuing insurance company.